What is Blockchain?

Move over, Bitcoin. Blockchain technology is increasingly gaining ground beyond trading cryptocurrency. But what exactly is it and how will it affect the world of logistics (among other things)?

As a current inhabitant of the 21st century, you are already familiar with how technology brings people and businesses together with ease. Social media, online shopping, news, you name it, the Internet has it just a few clicks away. But with such an open channel for commerce and communication, there comes some inherent risks: people snooping your public Facebook profile or accidentally opening a questionable attachment in an email whose address you can’t recall among them. Being wary of your own security is just as important in cyberspace as it is in the waking, physical world.

For now, we’ve relied on things like secure socket layering (or SSL, the little green padlock you’ll see in your browser’s address bar) and other forms of encryption to know which websites are safe from prying eyes looking to steal data. When it comes to money especially, we rely on tech-savvy banks to keep our transactions and accounts from being hacked and emptied. But these are all tools of websites and organizations; that’s a lot of trust that everyday users are putting in dozens (if not hundreds) of third parties on a daily basis. As more and more financial transactions are conducted online, there grows a need for both accessibility for consumers while still giving them protection from digital bandits.

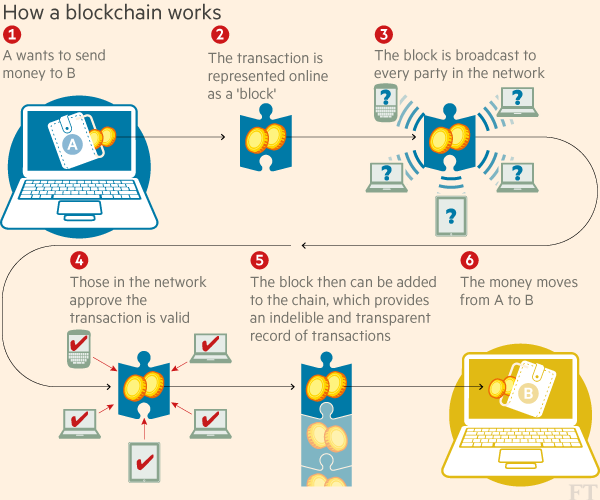

Blockchain is the next wave of Internet security protocol to do just that: giving individuals the power of making transactions without the need for an intermediary such as a bank. Instead, consumers and suppliers can connect to one another directly, encrypting these transactions (or blocks) on a decentralized database (a chain), with each user validating the transaction themselves. Once the transaction is approved by all parties in it, it’s completed, verified, and recorded. Financial Times has a useful illustration to explain the process simply:

The steps in a blockchain transaction | Source: Financial Times

While it can be used with real currencies such as the dollar, Euro, or pound sterling, it’s also been used for cryptocurrencies such as Bitcoin to keep users from spending the same Bitcoin more than once. Indeed, the decentralized database acts as a sort of ledger that keeps everyone honest. Moreover, the transaction can’t complete unless it’s verified by everyone anyway, giving users more control over their commercial dealings.

But will this financial model work in the future? Will it have a profound affect on modern business? Though it’s still being tried and tested, a lot of signs are pointing to yes.

The New Sharing Economy

There are more ways than ever to make money through the use of the Internet. From simply publishing and archiving information to turning your car into a taxi cab through services like Uber or Lyft, new value can be derived from things you’ve already purchased, owned, and used. With Airbnb, you can rent out that extra room (or even your whole house when you’re on vacation) to make some money on the side. These, and other services like them, are considered parts of the “sharing economy” as Longitudes defines it:

“The success of these companies is largely due to their ability to make use of existing assets people owned, that had been paid for, but from which new value could be derived. Effectively, these companies set up digital platforms that harnessed ‘excess capacity’ and relied on other people to deliver services. The same applies to other so-called ‘sharing economy’ companies that merely act as service aggregators and collect a cut off the top. In the process, they gather valuable data for further commercial gain.”

Throwing something like blockchain technology into the mix, however, might upset the new order that these companies have created. Much like banks acting as middlemen for financial transactions, so too do these services act as third parties between a service provider and their potential customers. Blockchain will allow for direct peer-to-peer connections that bypass third parties, giving rise to a new niche in the sharing economy: the peer-run marketplace.

As we touched on before, what makes blockchain more secure (on top of its encryption protocols) is the use of a digital ledger — the decentralized database that houses transaction information that all of those who belong to the network can pore over and check, keeping discrepancies to a minimum. The World Economic Forum predicts that while the technology only accounts for not even a tenth of the world’s GDP (as of writing, around $20 billion — or 0.025% global GDP — is housed in blockchain), it will “increase significantly” over the next ten years:

“In theory, if blockchain goes mainstream, anyone with access to the Internet would be able to use it to make transactions. […] The Forum’s research suggests this will increase significantly in the next decade, as banks, insurers, and tech firms see the technology as a way to speed up settlements and cut costs. Companies racing to adapt blockchain include UBS, Microsoft, IBM, and PwC. The Bank of Canada is also experimenting with the technology. A report from financial technology consultant Aite estimated that banks spent $75 million [in 2015] last year on blockchain. And Silicon Valley venture capitalists are also queuing up to back it.”

What makes blockchain so interesting is that it can be used for more than just financial transactions, but for sharing legal, physical, and electronic documents as well. With its algorithms, publicly-accessible database (at least to the network users), and transaction authentication measures, blockchain records are preserved with integrity and honesty — no one has the ability to tamper with them and everyone must acknowledge additions or changes to them. As Longitudes put it: “The technology’s trust protocol allows autonomous associations to be formed and controlled by the same people who are creating the value. All revenues for services, minus overhead, would go to members, who also control the platform and make decisions. Trust is not established by third parties, but rather through an encrypted consensus enabled by smart coding.”

So what are some ways this tech can be put to use?

Power to (and in some cases, from) the People

Blockchain has an obvious advantage when it comes to financial transactions: instead of relying on banks and other institutional third-parties to verify funds moving from point A to point B (which can take days, sometimes weeks), blockchain lets these transactions happen instantaneously. But what about some practical examples that trade other goods instead of cold, hard cash? What about, for example, selling excess electricity your house might have?

Jemma Green, a sustainability researcher from Curtin University in Perth, Australia looks to do just that with Power Ledger, a peer-to-peer energy trading company she co-founded. Green wants to capitalize on the trend of small-scale power generation as more homes are outfitted with solar panels that help offset their conventional energy costs. As local news source The West Australian put it: “[Green] said blockchain had the potential to complete change the way households used electricity by allowing them to buy and sell it from each other and chop out the retail middleman.” Green further added that “the owners of excess energy can sell their surplus to their neighbors for less than the uniform tariff but more than they would get from selling it to their retailer,” a move that would definitely shake up energy conglomerates here in the United States.

While trials are still underway for Power Ledger, this is but one instance of how blockchain enables everyday consumers to trade securely beyond traditional commercial relationships (that is, conducing their own trade without some sort of third-party to regulate them).

But just because blockchain mitigates regulation doesn’t mean others aren’t trying to keep transactions legitimate and certified. Stampery, another start-up service, provides ‘digital stamping’ of electronic documents such as emails to help prove authenticity and ownership. Stampery’s digital verification gives users four “proofs”: proof of ownership (that each attribution can be independently verified); proof of existence (to ensure the data existed at a certain point in time); proof of integrity (to monitor data integrity in real time); and proof of receipt (that a recipient actually received the data). Such certifications are useful for a wide variety of applications, especially when it comes to financial or legal dealings.

Speaking of both, blockchain is even being tried out as a share ownership register for companies like Overstock.com. Approved early last year by the US Securities and Exchange Commission (or SEC), Overstock is partnering with T0, allowing people to buy and sell shares among themselves while also enjoying almost instantaneous share settlement as opposed to the standard three-day waiting period. “Colored Chain,” the Bitcoin blockchain extension T0 uses for its “smart contracts” can also be used in larger purchases, such as real estate, where the buyer would send the currency and, after the contracts were signed, that currency would be released and available to the seller.

Keeping the Chain Secure

With its near-infinite scope of applications, blockchain does raise a few questions when it comes to regulation, especially since it allows anyone with Internet access to side-step service providers like banks and utility companies (among others) who’ve enjoyed economic hegemony over their customers. One such concern comes from the openness of these digital ledgers that allow anyone to view these transactions; the very feature that keeps people honest can also be used to find who holds the most of Overstock’s shares or what our friends down in Australia are selling their excess power for. And with all new, disruptive technologies, blockchain will be tested by both industry veterans who resist change that could threaten their market share as well as ne’er-do-well hackers trying to take advantage of new, albeit untested, security measures.

However, many companies remain optimistic that as the technology matures, the benefits will far outweigh any risks. As Longitudes explains:

“As with other disruptive technologies, there will be winners and losers. If the technology is successfully managed for scalable growth, it could very well disrupt established norms and transform our societies. Large layers of data generated by consumers today, which are controlled by hubs, can become public. In a world driven by blockchain, consumers can monetize their own data to derive greater value. By knowing when and how to take advantage of this technology, we have an opportunity to transform the digital platforms for tomorrow’s cities. The blockchain becomes the city’s operating system, invisible yet ubiquitous, improving citizens’ access to services, goods, and economic opportunities. Today, the technology is yet to mature. It remains to be seen if the expectations can live up to reality.”

Despite skepticism, one might recall the same curiosity and cynicism about the Internet in its debut but two-and-some-change decades ago. While blockchain is certainly an interesting, bold step for ecommerce and personal transactions of varying degrees, it’s steps like these that’ll cause a large shake-up in our reality, whether it’s lessons learned or foundations for new innovative programs, services and ideas.

And while the World Economic Forum believes that blockchain’s addition to the mainstream is inevitable, a lot of its barriers will be social rather than technological. Trying to remove third parties from transactions will retaining a lot of their benefits is no easy feat, and to keep up with any legal or financial regulations will be a challenge in and of itself. Regardless of hurdles this new technology faces, it still denotes a trend in giving ordinary people and businesses more control over their dealings with others, granting a swath of new opportunities for the savvy entrepreneurs to test and capitalize on while competition is still low.

Still, with smartphones, smart cars, smart refrigerators, and smart stereos, it’s only a matter of time before smart cities are added to the list of entities interwoven with smart technology.